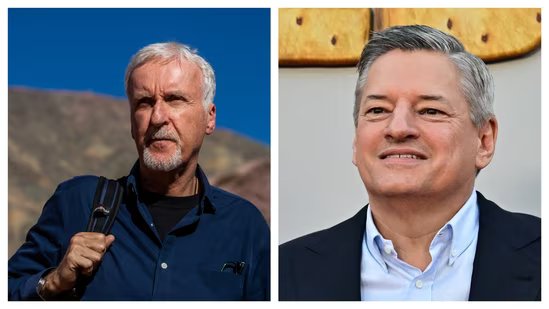

CEO of Netflix Ted Sarandos is not happy with James Cameron’s letter against the streaming platform over Warner Bros. Studios’ takeover bid, calling it “disastrous.” Hitting back at the comments, Sarandos said he was “surprised and disappointed” that Cameron had decided to engage with what he described as a disinformation campaign around the proposed deal.

Ted Sarandos hits back at James Cameron

Sarandos addressed Cameron’s comments in a letter to Republican Senator Mike Lee of Utah, who chairs the Senate subcommittee on antitrust. He noted that an earlier letter from the director “intentionally misrepresents our position and commitment to the theatrical release of Warner Bros. films.”

Sarandos’ letter follows an earlier note written by Cameron to Lee, which discussed the sale of Warner Bros.’ Film studios and streaming services Netflix “would be devastating to the theatrical motion picture business to which I have dedicated my life.”

“I recently read the letter that James Cameron sent you about our deal to acquire Warner Bros. Studios Warner Bros.’s Discovery from HBO — and specifically what impact they believe it will have on theaters. I respect Mr. Cameron very much and I like his work. But their letter to you knowingly misrepresents our position and commitment to the theatrical release of Warner Bros. films,” Sarandos wrote in the letter.

He continued, “When you and I met – and then when I testified under oath before the subcommittee – I said clearly that we will continue to release Warner Bros. films in theaters with a 45-day exclusive window, just as they are today. This is not a temporary goal or a flexible guideline; this is a hard number and a firm commitment. I said the same thing to Mr. Cameron when we met on December 20, 2025. We met shortly after we announced our agreement to acquire Warner Bros. During that meeting we talked about Netflix’s plans for Warner Bros., including our 45-day commitment. He was more excited to talk about the home viewing spectacles being developed with Meta than the exclusive window for theatrical films.

He said, “Mr. Cameron’s letter reflects none of this. He falsely suggests that we have only promised a 17-day window rather than 45, fails to accurately describe the deal Netflix has made and ignores the serious consequences for the industry if Paramount Skydance’s offer is accepted.”

Also spoke to the CEO of Netflix fox business Regarding the matter, he said, “I am particularly surprised and disappointed that James chose to be part of the Paramount disinformation campaign that has been going on for months about this deal.”

Sarandos noted that he was “surprised by the letter”, adding, “I’ve talked about that commitment countless times in the press. I swore before the Senate Subcommittee on Antitrust that that’s what we were doing.”

what james cameron said

In a letter to Senator Mike Lee, James Cameron wrote against the planned acquisition of Warner Bros. by Netflix. Cameron, the producer of blockbuster films like Avatar, Titanic and The Terminator, said the acquisition would be ‘disastrous’ for the film business.

“I strongly believe that the proposed sale of Warner Bros. Discovery to Netflix would be devastating to the theatrical motion picture business to which I have dedicated my life. Of course, all of my films also play in downstream video markets, but my first love is cinema,” Cameron wrote in the letter, quoted by Variety.

“Theatres will close. Fewer films will be made. Jobs will be lost,” the filmmaker warned in the letter. He added, “Netflix’s business model is in direct contradiction with the theatrical film production and exhibition business, which employs hundreds of thousands of Americans. So it is in direct contradiction with the business model of the Warner Bros. movie division, one of the few remaining major film studios.”

The filmmaker also shared that America may no longer be “the leader in auto or steel manufacturing, but it is still the world leader in movies. This will change for the worse”.

Last year, Netflix announced it would acquire Warner Bros., including its film and television studios, HBO Max and HBO Max. At the time, it was revealed that the cash and stock transaction was valued at $27.75 per WBD share, with a total enterprise value of approximately $82.7 billion (equity value of $72.0 billion). Since the announcement, Netflix has been active in addressing concerns surrounding the deal.